Last week for Euro was a big crash. Investors lost their confidence about Euro zone, when Greece problem was begun to solve. This caused the 1500 pips movement in EurJpy pair and 700 pips in EurUsd. In EurJpy weekly chart reversed Cup and Handle pattern did worked out. Support at 120.00 was broken.

The next week for EurJpy can be a continuation of bearish move towards 100.00 or can be traded in range between 110.00 and 120.00. Because of higher MACD level now than in second half of 2008, it may be a trend reversal sign, which may develop in month or two. But only good news in Euro zone and Japan’s export promotion can power up EurJpy to go up. But for now I would remain bearish or range.

The next week for EurJpy can be a continuation of bearish move towards 100.00 or can be traded in range between 110.00 and 120.00. Because of higher MACD level now than in second half of 2008, it may be a trend reversal sign, which may develop in month or two. But only good news in Euro zone and Japan’s export promotion can power up EurJpy to go up. But for now I would remain bearish or range.

In a daily chart we see formed two hammers with a long tails. Bullish Monday and/or Tuesday can be a sign of trend correction which can stop at 120.00 and continue to south. Breaking of this resistance can be a clue of possible reversal, but for reversals it takes time to develop. Breaking of 110.00 support can lead us to newer levels of underground.

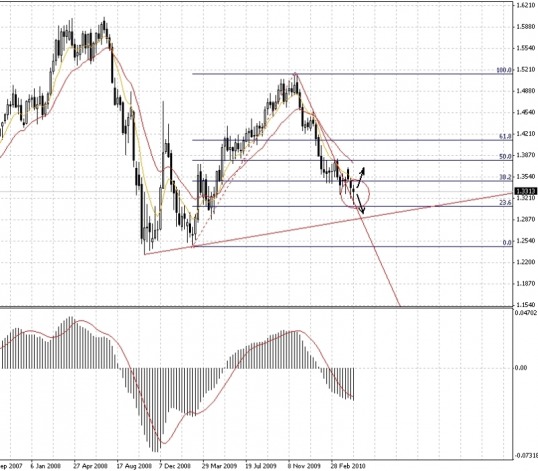

In weekly EurUsd chart we see, that the price has broken strong rising support at 1.29. Now I would rather expect correction than continuation of bear market. For now I don’t see any clues for a reversal.

Viewing the daily chart we see some hammers formed. As in EurJpy, first two days of the next week will show us the direction. Resistance at 1.30 is expected to be reached. Piercing it can couse a stronger correction, otherwise – continuation of bearish market towards supports at 1.20 – 1.23.

Next weeks news to follow: German GDP change, US trade balance change and retail sales on Friday. Also track, how economical situation in PIIGS countries is developing.

RSS Feed

RSS Feed